RESP Tax Benefit Calculator tools are a smart way for financial service providers to offer deeper, more practical insights to their clients. With one simple, interactive tool embedded on your website, you can show parents and caregivers exactly how much more they could save by using a Registered Education Savings Plan. These tools not only illustrate the value of tax-sheltered growth, but also position your firm as a knowledgeable, helpful partner in long-term financial planning.

RESP Tax Benefits Calculator

Calculate the tax benefits of investing in a Registered Education Savings Plan (RESP).

For organizations looking to differentiate, client-facing calculators provide a meaningful way to extend personalized advice—without adding advisor hours. The RESP Tax Benefit Calculator factors in key variables like taxable income, annual contributions, number of years contributing, and expected return on investment. The result is a clear, customized projection that makes the RESP’s tax advantages easy to understand—and act on.

By offering interactive calculators like the RESP Tax Benefit Calculator, you create a more engaging digital experience that draws users back to your site. Whether clients are exploring their first RESP or fine-tuning an existing plan, they’ll appreciate the clarity and confidence your tools provide. Leasing this kind of technology isn’t just about features—it’s about meeting people where they are, with advice that’s both accessible and actionable.

This calculator is also available in FreshPlan.

RESP Tax Benefits Calculator

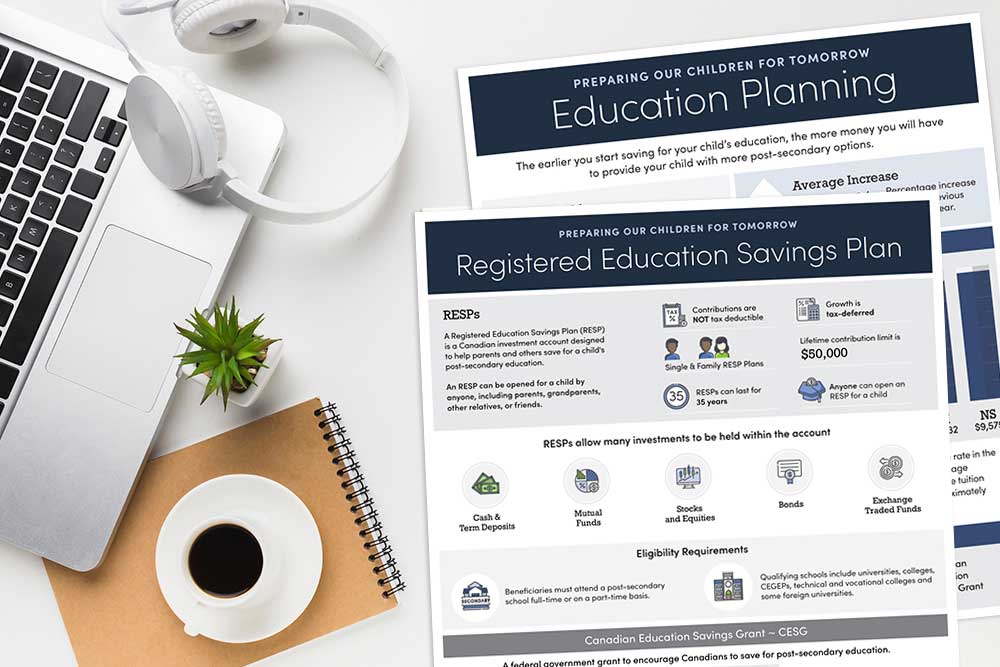

Companion Infographic

This FreshPlan RESP infographic highlights some details about the government approved Registered Education Savings Plan (RESP) designed to assist Canadians to save for post-secondary education. In addition the Canadian Education Savings Grant is explained. This infographic is a perfect companion to this calculator.

Features

Consumer-facing

These consumer-facing financial calculators can be embedded in your web site quickly and easily.

Responsive

Calculators are easy-to-use and fully responsive on any device – phone, tablet, laptop or desktop.

Full Branding

Calculators can be fully branded according to your branding style guide. You’ll be up and running with a quick turnaround.

Calculators are available in English and French.

The calculator can be viewed for free up to five (5) times.

To use the full-featured versions of these calculators in FreshPlan, please contact us.