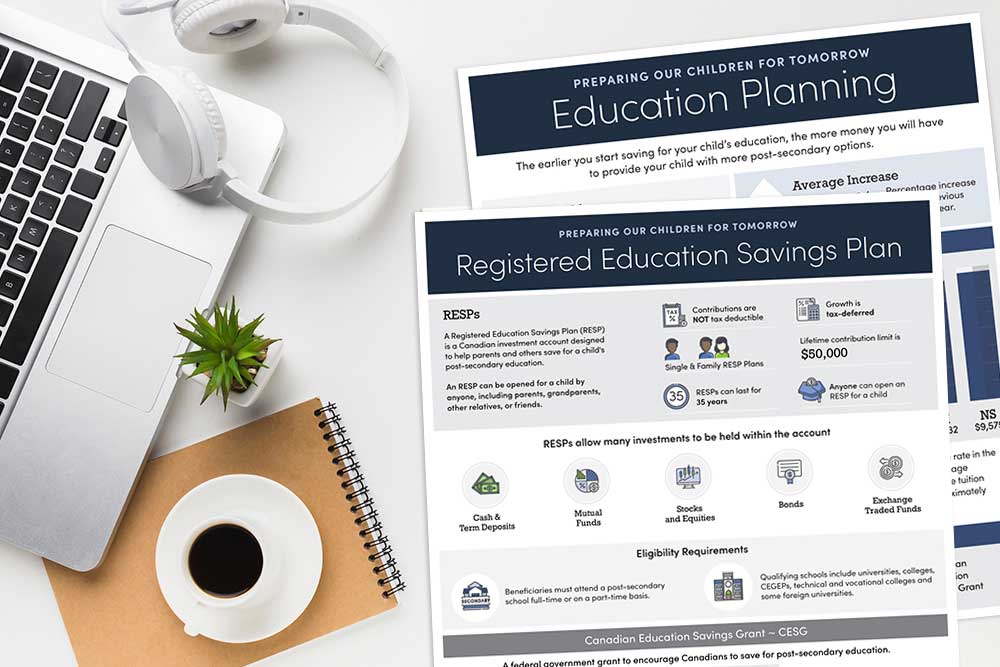

This RESP Infographic highlights this tax-sheltered plan that helps you save for a child’s post-secondary education faster.

Infographic highlights include how RESPs work, the eligibility requirements, and what investments are suitable to hold in your RESP. Also included is information on the Canada Education Savings Grant (CESG) and what happens if you are not able to use your RESP to pay for education after all.

An RESP is a tax-sheltered plan, sponsored by the Canadian government, that helps you save for a child’s post-secondary education faster. Unlike RRSPs, RESPs allow many investment vehicles inside the plan and the RESP can last up to thirty-five years.

This infographic highlights who is eligible and what investments you can place inside the plan. Discover more about how much you can contribute and when you can take the funds out.

Related Infographic:

• Education Planning