This Donate and Sell Shares Calculator estimates the tax savings from donating some shares and selling the rest. By donating securities directly to a charity as opposed to selling them and donating the proceeds, the capital gains tax can be eliminated.

Donate and Sell Shares Calculator

Estimate the tax savings from donating some shares and selling the rest and how it means more money for the charity and a greater charitable tax credit for you.

The Donate and Sell Shares Calculator considers where you live, your taxable income, value of the shares and the adjusted cost base. Donating securities is a tax-efficient way to donate to help the causes that are important to you.

Charitable Giving is an important part of tax and estate planning. Discover the many ways you can support organizations and the impact on your financial plan with these calculators:

• Charitable Donation

• Donating Shares to a Charity

• Gift in Kind Donation Calculator

Donate and Sell Shares Calculator

Companion Infographic

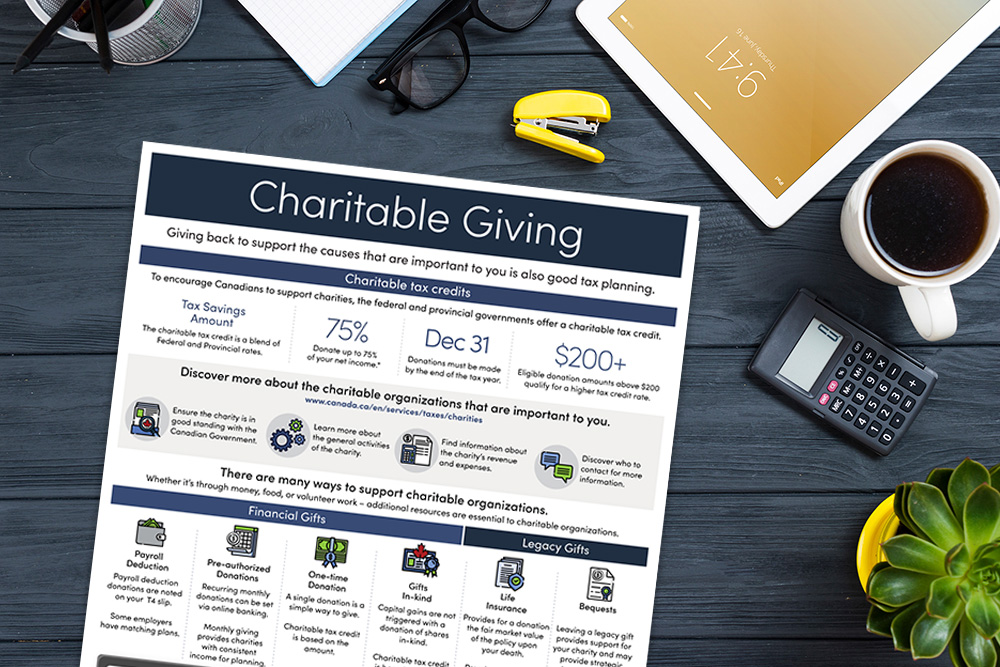

The Charitable Giving infographic works well as a companion piece to this calculator. The infographics highlights how supporting causes that are important to you is also good tax planning. Learn more about ways to support charitable organizations and the affect it may have on your taxes.

Features

Consumer-facing

These consumer-facing financial calculators can be embedded in your web site quickly and easily.

Responsive

Calculators are easy-to-use and fully responsive on any device – phone, tablet, laptop or desktop.

Full Branding

Calculators can be fully branded according to your branding style guide. You’ll be up and running with a quick turnaround.

The calculator can be viewed for free up to five (5) times.

To use the full-featured versions of these calculators in FreshPlan, please contact us.