This Diversify and Protect calculator illustrates how a well-designed portfolio can help weather different kinds of markets. Carefully investing in a variety of different assets can reduce risk associated with a single investment. Different kinds of assets often behave in different ways. Varied economic conditions lead to some assets performing well while others may perform less well.

Diversify and Protect Calculator

Discover how diversification can reduce the impact of a market decline on your portfolio.

With a broad range of investments, you’ll be in a better position to cope with market fluctuations and could benefit from more stable returns in the long run.

Historical perspective calculators help to provide insight into how a security or market has reacted to a variety of different variables. Companion calculators include:

• Staying Invested

• Stocks and Holding Periods

• Stock, Bonds and Cash

Diversify and Protect Calculator

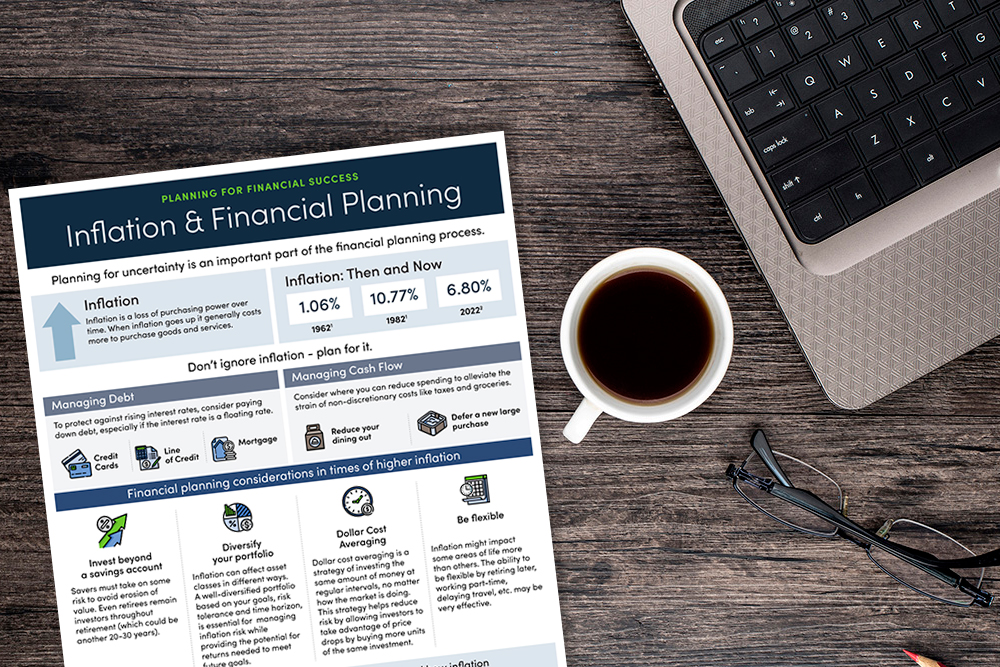

Companion Infographic

This infographic highlights the benefits of focussing on the long term, diversifying to reduce risk, and the importance of reviewing your plan. A financial professional is there to help clients avoid making rash decisions and to guide them during all market conditions.

Features

Consumer-facing

These consumer-facing financial calculators can be embedded in your web site quickly and easily.

Responsive

Calculators are easy-to-use and fully responsive on any device – phone, tablet, laptop or desktop.

Full Branding

Calculators can be fully branded according to your branding style guide. You’ll be up and running with a quick turnaround.

The calculators can be viewed for free up to five (5) times.

To use the full-featured versions of these calculators in FreshPlan, please contact us.