Use this Formula for Wealth calculator to illustrate how achieving financial goals involves tradeoffs between three investment components: Target goal, Time and Rate of Return.

Formula for Wealth Calculator

Discover how much clients need to invest bi-weekly, monthly, annually or as a single lump sum to reach a goal.

Sharing with Clients

Use the Formula for Wealth calculator with your clients to clearly show how achieving their financial goals involves balancing three key factors: target goal, time, and rate of return.

This tool helps bring their financial vision to life, empowering them to make confident, intentional decisions that drive them toward long-term success. It’s a powerful way to help them understand the trade-offs and stay on track toward their goals.

Triangle of Wealth

Sometime referred to as the Wealth Triangle, the formula for wealth investing concept deals with three major components.

Time

Time is a powerful component in building wealth. The longer your clients have to invest, the more their money can grow through the power of compounding. It’s important to help them understand that starting early and staying consistent can make a significant difference in achieving their long-term financial goals. By setting realistic timelines, you empower your clients to take intentional actions that lead to sustainable wealth.

When it comes to investing, the biggest cost you will face is the cost of waiting to invest.

Target Goal

Target Goal is the financial milestone your clients aim to achieve. Whether it’s retirement savings, a down payment for a home, or funding a child’s education, defining a clear target goal is crucial. This provides both direction and motivation. Working with clients to set specific, measurable goals ensures they stay focused and on track, making the path to financial independence more achievable.

Rate of Return

Rate of Return is the rate at which your clients’ investments grow over time. Helping them choose the right mix of investments based on their goals, risk tolerance, and time horizon is key. With a diversified approach, clients can aim for returns that align with their objectives. By optimizing their rate of return, you can confidently guide them toward reaching their target goal within the time frame they’ve set.

Discover how all these factors impact each other in the formula for wealth calculator.

Additional calculators to help with your planning include:

• Will the Money Last?

• Saving to Reach a Goal

• Present Value Calculator

Formula for Wealth Calculator

Companion Infographic

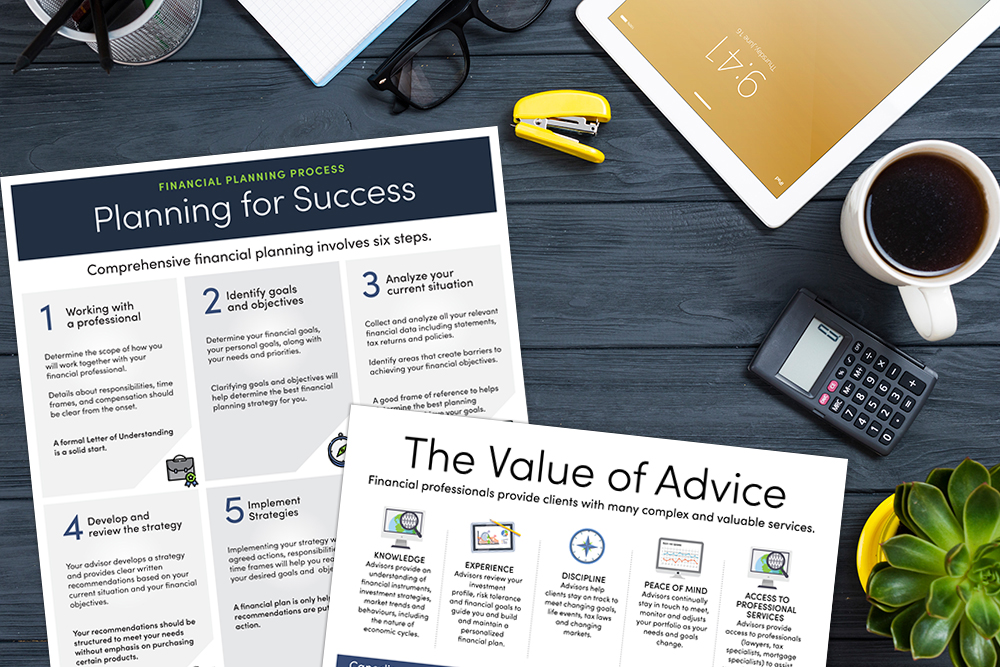

Comprehensive financial planning involves six steps. The Planning for Success infographic highlights how working with a financial professional helps to guide you through each step on the road to financial success.

Features

Consumer-facing

These consumer-facing financial calculators can be embedded in your web site quickly and easily.

Responsive

Calculators are easy-to-use and fully responsive on any device – phone, tablet, laptop or desktop.

Full Branding

Calculators can be fully branded according to your branding style guide. You’ll be up and running with a quick turnaround.

The calculators can be viewed for free up to five (5) times.

To use the full-featured versions of these calculators in FreshPlan, please contact us.